Introduction

What if 2026 becomes the year that completely reshapes the future of commercial real estate? From smarter office spaces to booming retail hubs and high-demand mixed-use developments, the commercial property market is evolving faster than ever. Investors, business owners, and developers are all watching closely as new trends begin to redefine how and where people work, shop, and connect. But what exactly is driving these changes, and which opportunities are worth paying attention to? In this blog, we’ll explore the most important commercial property trends in 2026 and what they could mean for your next big move.

Current Overview of the Commercial Property Market

The real estate world is entering an exciting phase, and Commercial Property Trends in 2026 clearly show a shift toward smarter, more flexible spaces. Businesses are no longer just looking for square footage—they want locations that support growth, technology, and long-term value. As a result, the commercial property market is becoming more dynamic and opportunity-driven than ever before.

Rising Demand for Flexible Spaces

One major highlight in Commercial Property Trends in 2026 is the growing demand for adaptable spaces. Companies prefer offices and retail units that can easily adjust to changing business needs.

Key changes include:

- Co-working and shared office setups

- Short-term lease options

- Multi-use commercial developments

This flexibility is reshaping how investors approach commercial property decisions.

Technology-Driven Developments

Smart buildings are becoming a standard feature. Modern commercial property projects now include:

- Energy-efficient systems

- Smart security and access controls

- High-speed digital infrastructure

These features not only reduce operational costs but also increase property value, aligning perfectly with Commercial Property Trends in 2026.

Growth in Tier-2 and Emerging Locations

Another noticeable shift is the rising interest in developing areas. Businesses are exploring affordable yet high-potential markets. Lower land costs and improving infrastructure make these locations attractive for commercial property investments.

Focus on Sustainability

Sustainability is no longer optional. Green buildings, eco-friendly designs, and energy-saving systems are influencing buyer decisions. Investors now see environmentally responsible commercial property as both ethical and profitable.

Key Commercial Property Trends in 2026

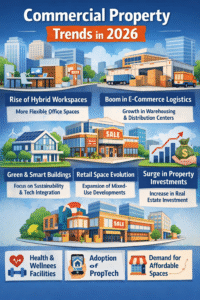

The real estate landscape is changing fast, and Commercial Property Trends in 2026 highlight where the biggest opportunities are emerging. Investors and business owners are rethinking how they use space, where they invest, and what features truly matter. Let’s explore the key trends shaping the future of commercial property this year.

Smart & Tech-Enabled Buildings

Technology is leading the transformation. Modern commercial property projects now focus on:

- Smart lighting and energy systems

- Advanced security solutions

- Automated building management

These features reduce costs and improve efficiency, making properties more attractive to tenants and investors.

Flexible and Hybrid Workspaces

The demand for adaptable spaces continues to grow. One of the strongest Commercial Property Trends in 2026 is the rise of hybrid offices and co-working environments. Businesses prefer:

- Short-term leases

- Shared office models

- Multi-purpose layouts

This flexibility allows companies to scale without long-term risk.

Growth of Mixed-Use Developments

Developers are combining retail, office, and entertainment spaces in one location. This trend increases foot traffic and creates vibrant business hubs. Mixed-use commercial property projects are becoming highly desirable in urban and semi-urban areas.

Sustainability and Green Design

Eco-friendly construction is no longer optional. Energy-efficient systems, green certifications, and sustainable materials are influencing buyer decisions. Investors now see environmentally responsible commercial property as a smart long-term investment.

Expansion in Emerging Markets

Another important part of Commercial Property Trends in 2026 is the shift toward Tier-2 cities and growing business corridors. Lower prices and improving infrastructure are attracting attention.

Investment Opportunities in Commercial Property in 2026

As the market evolves, Commercial Property Trends in 2026 are opening new doors for smart investors. This year is not just about buying space—it’s about choosing the right location, format, and long-term strategy. Let’s explore where the real opportunities lie in commercial property.

High-Growth Business Locations

Emerging cities and developing business corridors are attracting attention. Investors are targeting areas with:

- Improving infrastructure

- Growing population and workforce

- Strong connectivity

Such locations often offer better entry prices and higher appreciation potential in commercial property investments.

Retail & Experience-Based Spaces

Retail is changing. Instead of traditional stores, demand is rising for experience-driven spaces like:

- Food courts and entertainment zones

- Lifestyle and shopping hubs

- Mixed-use developments

These formats align closely with Commercial Property Trends in 2026, as consumers now prefer destinations over simple shopping centers.

Co-Working and Flexible Offices

Hybrid work models continue to grow. Investing in flexible office spaces can generate steady rental income. Many businesses now prefer shared or managed office solutions within commercial property projects.

Warehousing & Logistics

With the rise of e-commerce, logistics hubs and warehouses are becoming profitable segments. Well-located commercial property near highways and transport hubs offers strong long-term returns.

Green & Smart Buildings

Sustainability is also shaping Commercial Property Trends in 2026. Energy-efficient buildings reduce operational costs and attract quality tenants, making them a future-ready investment choice.

Challenges Facing Commercial Property in 2026

While opportunities are growing, Commercial Property Trends in 2026 also reveal several challenges that investors and developers must navigate carefully. The market is evolving quickly, and staying prepared is just as important as spotting the right opportunity. Let’s take a closer look at the key obstacles facing commercial property this year.

Economic Uncertainty

Fluctuating interest rates and changing economic conditions can impact returns. Many investors are cautious about large commercial property commitments due to:

- Rising borrowing costs

- Inflation pressures

- Shifting business confidence

These factors can slow down new investments and leasing activity.

Changing Work Patterns

Hybrid and remote work models continue to influence office demand. One of the major concerns highlighted in Commercial Property Trends in 2026 is the reduced need for traditional office space. Businesses are downsizing or choosing flexible workspaces instead of long-term leases.

Rising Construction Costs

Material prices and labor expenses remain high in many regions. This increases development costs for new commercial property projects, affecting overall profitability and timelines.

Increased Competition

As more developers enter growing markets, competition is becoming stronger. To stand out, commercial property owners must offer:

- Modern amenities

- Competitive rental pricing

- Value-added services

Without differentiation, maintaining occupancy rates can become challenging.

Regulatory and Compliance Issues

Government policies, zoning laws, and environmental regulations are also evolving. Keeping up with compliance requirements adds complexity to managing commercial property investments.

How Investors Can Prepare for Commercial Property Trends in 2026

The market is shifting quickly, and understanding Commercial Property Trends in 2026 is the first step toward making smart investment decisions. Instead of reacting late, investors should focus on planning ahead and adapting to changing market needs. Here’s how you can stay prepared in the evolving commercial property landscape.

Focus on Location Strategy

Location still plays a major role in success. Investors should research:

- Growing business hubs

- Upcoming infrastructure projects

- Demand patterns in Tier-2 cities

Choosing the right commercial property in a high-potential area can significantly improve long-term returns.

Diversify Your Portfolio

One key lesson from Commercial Property Trends in 2026 is not to rely on a single asset type. Consider spreading investments across:

- Office spaces

- Retail outlets

- Warehousing and logistics units

- Mixed-use developments

Diversification reduces risk and creates multiple income streams within commercial property investments.

- Prioritize Flexibility and Modern Features

Tenants today prefer smart, adaptable spaces. Look for commercial property projects that offer:

- Flexible layouts

- Energy-efficient systems

- Advanced security and digital infrastructure

- Modern amenities attract quality tenants and improve occupancy rates.

Stay Updated on Regulations and Market Data

Regularly reviewing policy changes, tax structures, and market reports helps investors make informed decisions. Being aware of legal and compliance requirements ensures smoother commercial property management.

Plan for Long-Term Value

Instead of focusing only on short-term gains, align your strategy with long-term Commercial Property Trends in 2026. Sustainable and future-ready properties are likely to perform better over time.

Future Outlook Beyond 2026

As we analyze Commercial Property Trends in 2026, it’s equally important to look ahead. The decisions made today will shape the direction of the commercial property market in the coming years. While 2026 sets the foundation, the future promises even more transformation and innovation.

Continued Technological Integration

Technology will move from being an added feature to becoming a basic requirement. Future commercial property developments are expected to include:

- AI-powered building management systems

- Advanced energy monitoring tools

- Smart parking and automated access

These upgrades will improve efficiency and reduce operational costs over time.

Stronger Focus on Sustainability

Sustainability trends highlighted in Commercial Property Trends in 2026 will only grow stronger. Developers are likely to prioritize:

- Net-zero energy buildings

- Green certifications

- Eco-friendly construction materials

Environmentally responsible commercial property projects may attract higher demand and premium tenants.

Growth of Mixed-Use Ecosystems

The line between work, lifestyle, and entertainment will continue to blur. Integrated developments combining offices, retail, hospitality, and residential spaces are expected to dominate the market. This model increases footfall and enhances long-term property value.

Expansion into Emerging Markets

Beyond 2026, more investors may explore developing cities and new business corridors. Lower entry costs and improving infrastructure will make commercial property in these areas a strategic choice.

Evolving Tenant Expectations

Tenant needs will keep changing. Flexible layouts, wellness-focused designs, and digital connectivity will become standard features in modern commercial property spaces.

Conclusion

In summary, Commercial Property Trends in 2026 highlight a market that is evolving with technology, flexibility, and sustainability at its core. From smart buildings and mixed-use developments to emerging business hubs and green construction, the commercial property sector is becoming more dynamic and opportunity-driven. At the same time, investors must stay alert to challenges such as economic shifts, changing work models, and rising competition.Looking ahead, those who adapt early, diversify wisely, and focus on long-term value will be better positioned for success. The future of commercial property belongs to investors who are informed, flexible, and ready to grow with the market.

Frequently Asked Questions.

Q. What are the key Commercial Property Trends in 2026?

Ans.The major Commercial Property Trends in 2026 include smart buildings, flexible workspaces, mixed-use developments, sustainable construction, and growth in emerging business locations.

Q. Is commercial property a good investment in 2026?

Ans.Yes, commercial property can offer strong returns, especially in high-growth areas and sectors like warehousing, retail hubs, and flexible office spaces. However, proper research and long-term planning are important.

Q. How is technology impacting commercial property?

Ans.Technology is transforming commercial property through smart security systems, energy-efficient solutions, digital infrastructure, and automated building management, making properties more efficient and attractive to tenants.